pitomniki-rus.online Overview

Overview

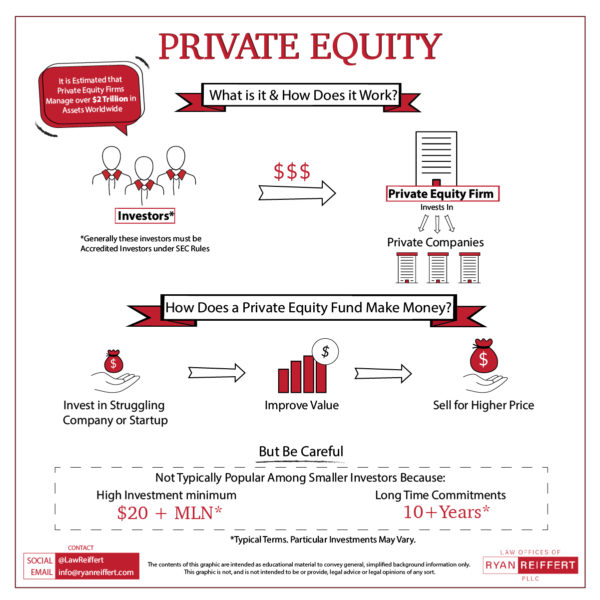

Whats A Private Equity Firm

Private equity funds are closed-end investment vehicles, which means that there is a limited window to raise funds and once this window has expired no. Private equity refers to ownership in a private company, often done through private equity funds that cater to high-net-worth investors. Similar to a mutual fund or hedge fund, a private equity fund is a pooled investment vehicle where the adviser pools together the money invested in the fund by. What is private equity? Private equity is a form of investment partnership in which the private equity firm, as the general partner (GP), provides capital to. When the target is publicly traded, the private equity fund performs a public-to-private transaction, removing the target from the stock market. But buyout. Bain Capital Private Equity pioneered the value-added investment approach. We partner with management teams around the world to accelerate growth. Private equity operates with investors and uses funds to invest in private companies or buy out public companies. By doing so, general partners can obtain. What is private equity? · Raises funds of money from a variety of sources that will invest in private businesses (versus public stocks and bonds) · Relies on a. Private equity firms are basically like those investors who flip houses, but instead they flip entire companies. They buy struggling businesses. Private equity funds are closed-end investment vehicles, which means that there is a limited window to raise funds and once this window has expired no. Private equity refers to ownership in a private company, often done through private equity funds that cater to high-net-worth investors. Similar to a mutual fund or hedge fund, a private equity fund is a pooled investment vehicle where the adviser pools together the money invested in the fund by. What is private equity? Private equity is a form of investment partnership in which the private equity firm, as the general partner (GP), provides capital to. When the target is publicly traded, the private equity fund performs a public-to-private transaction, removing the target from the stock market. But buyout. Bain Capital Private Equity pioneered the value-added investment approach. We partner with management teams around the world to accelerate growth. Private equity operates with investors and uses funds to invest in private companies or buy out public companies. By doing so, general partners can obtain. What is private equity? · Raises funds of money from a variety of sources that will invest in private businesses (versus public stocks and bonds) · Relies on a. Private equity firms are basically like those investors who flip houses, but instead they flip entire companies. They buy struggling businesses.

What is a portfolio company? Portfolio companies are businesses that receive investment and management expertise from private equity funds. When fund. What Is Private Equity (PE) And How Does It Work? Definition of Private Equity: Private equity firms raise capital from outside investors, called Limited. What is private equity? Private equity is an investment in the ownership of a private or public company that may be delisted from a stock exchange. These. Any investment where a company or subsidiary is acquired from its shareholders. See also 'management buyout' and 'secondary buyout'. Capital gains. The. An equity firm or private equity firm refers to an investment company that utilizes its own funds or capital from other investors for its expansion and startup. Private equity is an investment strategy where a firm buys, acquires, or directly invests in companies or securities that are private, i.e., not listed or. Private equity firms invests money in firms that have not yet gone public. the firm could be public or private. Private investment firms are. You still need a specific, repeatable, and understandable investment strategy. · And you'll still market your new fund to funds of funds, endowments, pensions. Private equity funds are closed-end investment vehicles, which means that there is a limited window to raise funds and once this window has expired no. Independent private equity and venture capital firms typically raise money from institutional investors such as pension funds, insurance companies and family. Private equity (PE) is capital stock in a private company that does not offer stock to the general public. In the field of finance, private equity is. In fact, private equity firms develop an exit strategy for each business during the acquisition process. Assumptions about exit price are probably the most. What is Private Equity? · A source of capital for companies in need · A key driver in innovation, economic growth and sustainability · A job creator and supporter. What is Private Equity? Private equity is a broad class of investment wherein investors raise funds to acquire, restructure, and profit from private companies. Both “private equity firms” and “venture capital firms” raise capital from outside investors, called Limited Partners (LPs) – pension funds, endowments. You can think of private equity firms as a type of investment club. The principal investors (also known as Limited Partners) are institutions like investment. Warburg Pincus LLC is a leading global growth investor. The firm has an active portfolio of more than companies and is headquartered in New York. They come with a fixed investment horizon, typically ranging from four to seven years, at which point the PE firm hopes to profitably exit the investment. Exit. Private equity is an alternative investment class that encompasses funds, investors, or investment companies directly investing in private companies or engaging.

App To Give You Money Before Payday

EarnIn: Best for large cash advances The EarnIn app tracks your location or work hours to determine how much you can borrow. If you need more than other apps. DailyPay and Kroger teamed up so you can get your earned pay any time before payday. Two smartphones displaying a finance app. One screen shows a $ Get a Klover cash advance up to $ cash – even if your payday is 2 weeks away. And unlike banks, there are no late fees, credit checks or interest charges. With Earned Wage Access (EWA) you can get a portion of the money you've already earned before payday and avoid high interest loans, overdrafts and late fees. EarnIn is a cash advance app available on both Apple and Android devices. It offers cash advances of up to $ per pay period and operates on a tip-based. Typically, you download the borrow money app, provide access to an external bank account that has direct deposit set up, and within minutes – or sometimes a few. Cash Advance Apps: Apps like PayDaySay, Dave, and Brigit can provide small cash advances quickly. While you've probably considered these, they. For you to receive early access to your wages, your employer, like Branch, must provide PayActiv as a perk to its workers. PayActiv may track your earned (but. EarnIn is a cash advance app available on both Apple and Android devices. It offers cash advances of up to $ per pay period and operates on a tip-based. EarnIn: Best for large cash advances The EarnIn app tracks your location or work hours to determine how much you can borrow. If you need more than other apps. DailyPay and Kroger teamed up so you can get your earned pay any time before payday. Two smartphones displaying a finance app. One screen shows a $ Get a Klover cash advance up to $ cash – even if your payday is 2 weeks away. And unlike banks, there are no late fees, credit checks or interest charges. With Earned Wage Access (EWA) you can get a portion of the money you've already earned before payday and avoid high interest loans, overdrafts and late fees. EarnIn is a cash advance app available on both Apple and Android devices. It offers cash advances of up to $ per pay period and operates on a tip-based. Typically, you download the borrow money app, provide access to an external bank account that has direct deposit set up, and within minutes – or sometimes a few. Cash Advance Apps: Apps like PayDaySay, Dave, and Brigit can provide small cash advances quickly. While you've probably considered these, they. For you to receive early access to your wages, your employer, like Branch, must provide PayActiv as a perk to its workers. PayActiv may track your earned (but. EarnIn is a cash advance app available on both Apple and Android devices. It offers cash advances of up to $ per pay period and operates on a tip-based.

It takes only minutes to download the Dave app, securely link your bank, and send the money to a Dave Checking account. Start now. Life happens. ExtraCash™ can. We found that Brigit is safe and legit when analyzing apps that give loans. The loan app will front you up to $ until payday, and you can apply on the cash. The Earnin mobile app allows you to get paid when you work — not only on payday. When you open an account, you can link your work time sheet to an active. Instantly access your pay in advance — without waiting for a paycheck. EarnIn lets you access your pay as you work — not days or weeks later. Meet FloatMe, your Best Financial Friend designed to help you get, manage, and save money. Get fast cash advances directly to your bank account and more by. ✅ EarnIn: Distinguished by its unique model that allows users to access earned wages ahead of payday, EarnIn offers a free cash advance app. It's just a cash advance from the Klover app. You can access up to $ – even if your payday is 2 weeks away. The best part? There is zero interest or late. Discover the best cash advance apps that can provide you with the funds and features you need with as few fees as possible. So far, we've talked about money lending apps like Dave and Albert that can get you quick cash when you need it, but they also chuck yet another monthly. EarnIn is a single-purpose cash advance app. It lends you money against your future paycheck at no cost. EarnIn doesn't require a credit check. The app is. Dave: Best paycheck advance app with flexible repayments · Up to $ · Two to three business days ; EarnIn: Best for paycheck advance app for large advances · Up. DailyPay is an earned income, or wage, access app, which means that you can retrieve money you've earned during a pay period before payday. Employers must. Albert is a multipurpose banking app. With Albert, you can open a bank account, get a debit card, put money away into savings and more. There's also an. Albert Instant. Albert is another app that provides access to money advances of up to $ To qualify, establish a direct deposit setup and offer evidence of. Gerald can send you up to half of your paycheck early. It's your money, so there's no reason you shouldn't have access to it sooner. When your real payday comes. Dave: Dave is a budgeting app that also offers cash advances of up to $ without charging interest or fees. It does offer an optional monthly. Get a paycheck advance with early direct deposit when you need it, because life doesn't always wait for payday. Woman stands beneath an open white umbrella and. Varo gives you cash advances starting at $ You can extend your pay advance limit through direct deposits and a history of timely payments. The app also gives. Sometimes, you just need a little extra cash to get you through until your next payday. That's where cash advance apps like Dave and Earnin come in. These apps. DailyPay is an app that allows employees to access their earned wages before payday. It promotes financial empowerment by giving you early.